The increase is for 2021 only. The new DC-FSA annual limits increases to 10500 up from 5000 for single taxpayers and married couples filing jointly and to 5250 up from 2500 for married individuals filing separately.

Https Www Fsafeds Com Support Resources Translator Dcfsa Flyer

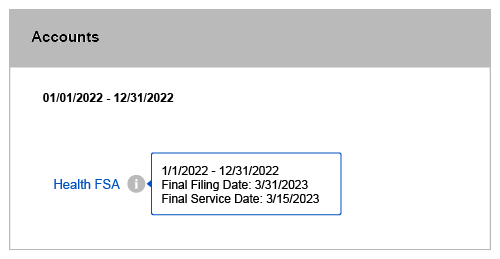

The limit for health FSAs in 2021 is 2750 unchanged from 2020 and unaffected by the latest stimulus bill.

Day care fsa limits 2021. Care for your child who is under age 13 Before and after school care. For calendar year 2021 only the dependent care flexible spending account DCFSA annual salary reduction limit is increased from 5000 to 10500. One of the provisions included in ARPA temporarily increased the limits on dependent care FSAs for 2021.

For calendar year 2021 the dependent care flexible spending account FSA pretax contribution limit increases to 10500 up from 5000 for. Dependent Care FSA Eligible Expenses. ARPA automatically sunsets the increased dependent care FSA limit at the end of 2021.

Prior to the American Rescue Plan being enacted in March of 2021 DCFSA contributions were limited to 5000 a year for individuals or married couples filing jointly and. For this year only if you are currently enrolled you can contribute up to 10500 to your Day Care FSA or 5250 if married and filing separately. Employee can still elect to contribute 10500 for the 2021 plan year.

This makes 15500 available in the 2021 plan year 5000 carried over from 2020. A dependent day care FSA permitted but not required to increase the maximum contribution limit. As with the standard rules the limit is reduced to half of that amount or 5250 for married individuals filing separately.

The maximum limit for the 2021 tax year is 10500 for unmarried individuals or individuals filing a joint tax return and 5250 for married individuals filing separately. For single filers the limit is 5250 up from 2500. Babysitting and nanny expenses.

Provides flexibility to extend the permissible period for incurring claims for plan years ending in 2020 and 2021. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to. ARPA provides that the dependent care FSA limit for calendar year 2021 will be 10500.

This provision is optional for employers. They are not required to increase the limits. The IRS increased the limit for the 2021 plan year from 5000 to 10500.

Suggested read: Day Care Highland Park

The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples. With the recent passage of the American Rescue Plan Act of 2021 ARPA you are now able to contribute up to 10500pre-taxinto your 2021 Day Care Flexible Spending Account FSA. Notice 2021-15 provides flexibility for employers in the following areas related to health FSAs and dependent care assistance programs.

Employer also adopts the increased 10500 dependent care FSA limit for 2021. For married individuals filing separate tax returns the limit is increased from 2500 to 5250. Effective immediately you may newly enroll or increase your existing election for the Dependent Care Flexible Spending Account FSA through the Missouri State Employees Cafeteria Plan MoCafe.

The American Rescue Plan Act ARPA raises pretax contribution limits for dependent care flexible spending accounts DC-FSA for the 2021 calendar year. President Biden signed the bill into law on Thursday March 11. Provides flexibility for the carryover of unused amounts from the 2020 and 2021 plan years.

The American Rescue Plan Act of 2021 gives employers the option to increase the dependent care flexible spending account DCFSA reimbursable limit to 10500 5250 for married couples filing separate tax returns for the 2021 calendar year. Now single filers can contribute up to 5250 increased from 2500 and married couples filing jointly can contribute up to 10500 increased from 5000. The money you contribute to a Dependent Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck.

Cobra Subsidies Fsa Dependent Care Increase And Benefit Extensions From Arpa Navia

Flexible Spending Accounts Mychoice Accounts Businessolver

Flexible Spending Accounts How An Fsa Works Optum Financial Plans

Dependent Care Fsa Increase And Full Cobra Subsidies Pass Congress Newfront Insurance And Financial Services

Increase In Dependent Care Fsa Under The American Rescue Plan Act Tri Ad

Suggested read: Day Care How Old

Cobra Subsidies Fsa Dependent Care Increase And Benefit Extensions From Arpa Navia

Dependent Care Fsa Faqs Expenses Limits More Optum Financial

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Flexible Spending Accounts Fsa 2020

Flexible Spending Account Nuesynergy

Using Bestflex Fsa Employee Benefits Corporation Third Party Benefits Administrator

Dependent Care Fsa Faqs Expenses Limits More Optum Financial

Dependent Care Assistance Program Optum Financial

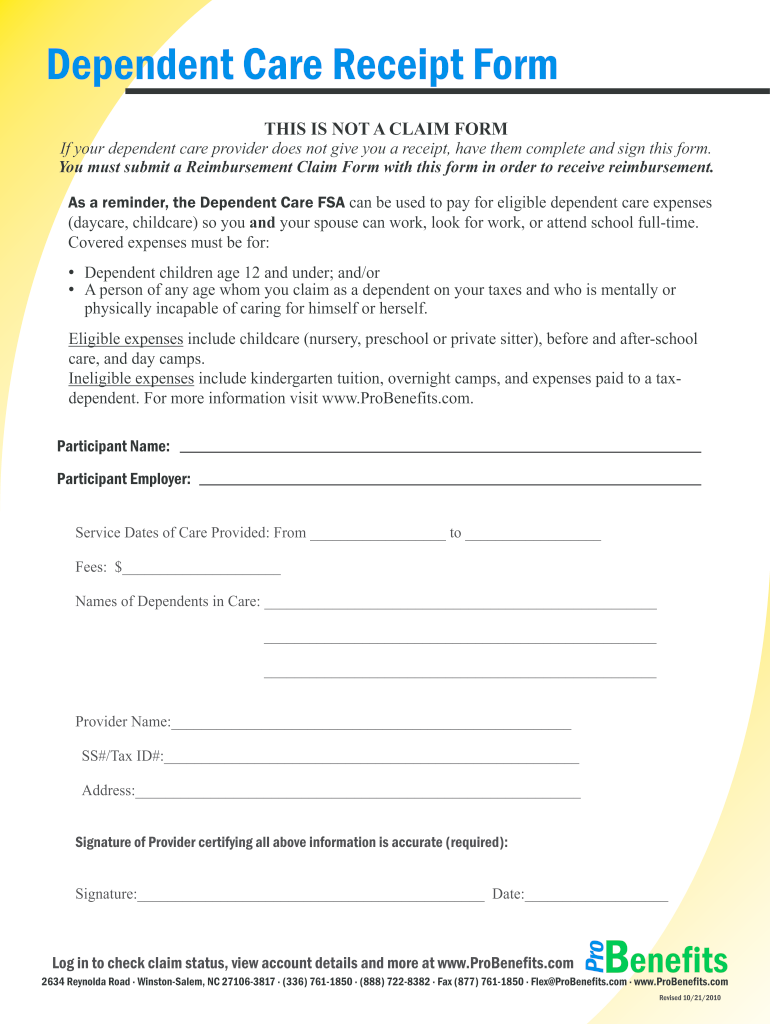

Dependent Care Fsa Babysitter Receipt Fill Online Printable Fillable Blank Pdffiller

Understanding The Year End Spending Rules For Your Health Account

Suggested read: Day Care In Kr Puram

Optimize Tax Savings From Dependent Care Fsa Child And Dependent Care Tax Credit Video In 2021 Tax Credits Childcare Costs Tax

Use A Dependent Care Account To Lower Your 2021 In Home Care Expenses Care Com Homepay

Unused Dependent Care Fsa Funds Tax Compliance Alert Paylocity

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning