A payment mechanism provides access to medical services and resources, typically offered as part of a comprehensive healthcare package. It facilitates the reimbursement or direct payment for covered medical expenses, simplifying the process for the cardholder. For instance, an individual might use this card at a pharmacy to purchase prescription medication or at a doctor’s office to pay for a consultation.

The provision of such a resource streamlines healthcare access and financial management for beneficiaries. It can contribute to improved health outcomes by reducing financial barriers to care. The origin of these cards can be traced back to efforts to standardize and simplify healthcare payments, evolving alongside advancements in technology and healthcare administration.

The subsequent sections will delve into the specific features, eligibility requirements, and utilization guidelines associated with this particular healthcare payment tool, providing a detailed overview of its functionality and benefits.

1. Eligibility Criteria

Eligibility criteria are paramount in determining who can access the advantages associated with the payment mechanism. These established requirements ensure that the resource is allocated appropriately and equitably within the framework of its intended purpose.

-

Employment Status

Employment status frequently serves as a foundational criterion. Full-time, part-time, or retired employees of a specific organization might qualify. For instance, a company offering a healthcare package to its full-time staff would restrict access to individuals meeting this employment condition. This stipulation aligns the benefit with active or former contributions to the organization.

-

Dependence Status

Dependence status often extends coverage to eligible dependents of the primary cardholder. This can include spouses, children, or other legally recognized dependents, subject to age and residency requirements. An example is a plan that allows employees to cover their children until age 26. This provision broadens the reach of healthcare access within the family unit.

-

Residency Requirements

Residency within a specific geographic area may be a prerequisite. This ensures that the benefits are utilized within a defined network of healthcare providers. For example, a regional healthcare program might limit access to residents of that particular state or county. This limitation is designed to streamline administration and control costs.

-

Enrollment Period

Enrollment periods dictate when individuals can apply for and receive the payment mechanism. These periods are typically annual or coincide with specific life events. An example would be an open enrollment period each November for coverage starting in January. This structured timeline allows for efficient processing and management of applications.

These criteria, when considered holistically, dictate the scope of access to the healthcare payment mechanism. Adherence to these requirements is essential for ensuring that the intended beneficiaries receive the intended resources, thereby contributing to the overall effectiveness of the healthcare program.

2. Covered Services

The scope of “covered services” is fundamental to understanding the utility of the healthcare payment mechanism. These delineate the specific medical treatments, procedures, and resources for which the cardholder can utilize the provided funds, directly impacting healthcare accessibility and financial planning.

-

Preventative Care

Preventative care often forms a core component, encompassing services such as annual physicals, vaccinations, and screenings. For instance, coverage might include a yearly flu shot or routine blood tests to monitor cholesterol levels. This emphasis on prevention aims to detect potential health issues early, mitigating more costly interventions in the long term. The inclusion of these services through the payment mechanism encourages proactive healthcare management among cardholders.

-

Prescription Medications

Access to prescription medications represents a significant benefit, enabling cardholders to obtain necessary drugs at reduced or no cost, depending on the plan’s formulary and co-pay structure. For example, the card might facilitate the purchase of insulin for a diabetic patient or antibiotics for an infection. The extent of coverage varies, often involving tiers or preferred drug lists. Such access is crucial for managing chronic conditions and acute illnesses effectively.

-

Specialist Consultations

The payment mechanism may extend to consultations with medical specialists, allowing cardholders to seek expert opinions and treatments in various fields. For instance, a referral to a cardiologist for a heart condition or a dermatologist for a skin ailment could be covered. The availability of specialist care addresses more complex health needs and ensures comprehensive medical support. Limitations may apply, such as requiring prior authorization from a primary care physician.

-

Emergency Services

Coverage for emergency services provides crucial financial protection in unforeseen medical crises. This typically includes ambulance transportation, emergency room visits, and urgent care services. For example, the cardholder could use the benefits to cover costs associated with a sudden injury or illness requiring immediate medical attention. The presence of this benefit offers peace of mind and ensures access to critical care when needed most. Specific limitations, such as network restrictions, might apply to out-of-area emergencies.

The specific composition of covered services dictates the real-world value and practicality of the healthcare payment mechanism. Understanding these services empowers cardholders to make informed healthcare decisions and effectively manage their healthcare expenses. The comprehensive nature of coverage directly influences the overall health and well-being of the individuals utilizing this system.

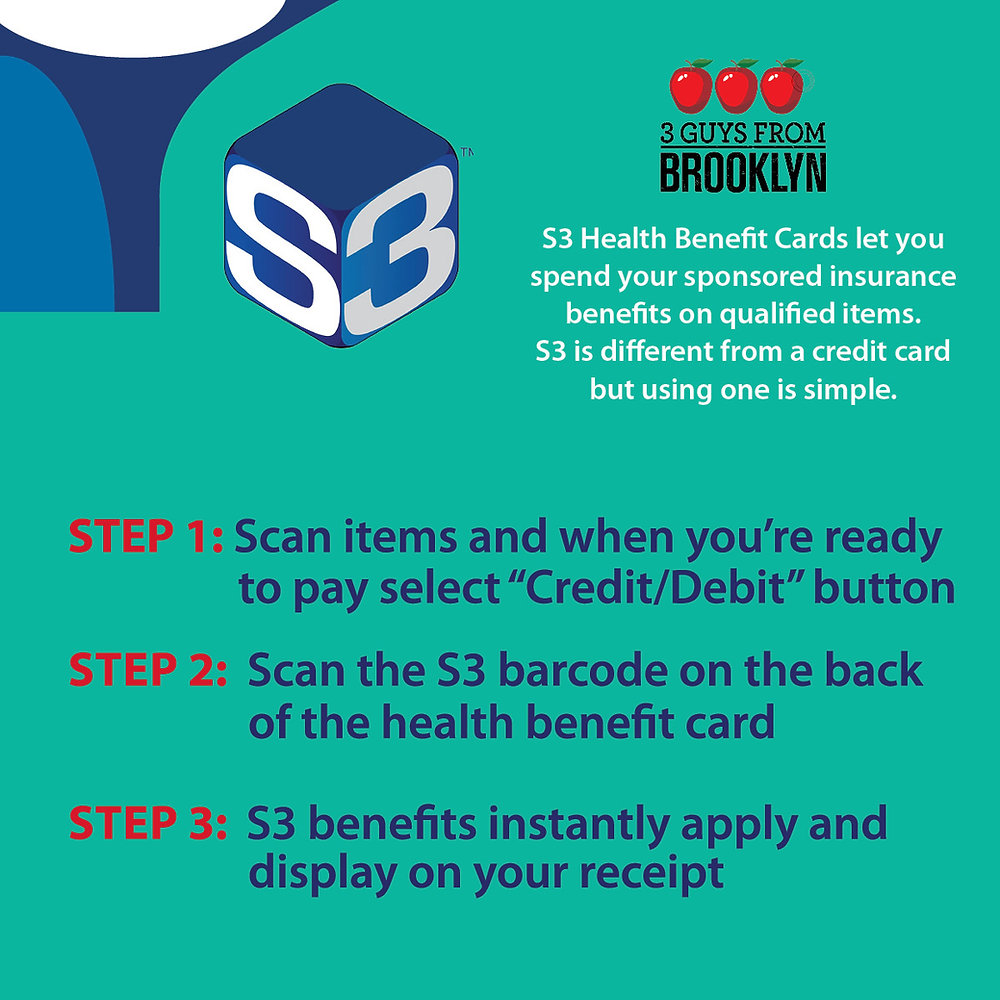

3. Card Activation

Card activation constitutes a critical procedural step in realizing the intended utility of the healthcare payment mechanism. Activation transforms the inactive card into a functional tool, allowing eligible individuals to access the benefits provided. Failure to complete this process effectively nullifies the card’s purpose and prevents beneficiaries from utilizing their allocated healthcare funds.

-

Verification of Identity

Identity verification stands as a cornerstone of the activation process. This typically involves providing personal information, such as date of birth, social security number, or member identification number, to confirm the applicant’s eligibility and prevent fraudulent use. For instance, an online activation portal might require the cardholder to match their information against records held by the insurance provider or benefits administrator. Successful verification unlocks the card’s functionality, ensuring that only authorized individuals can access the benefits.

-

Secure PIN Selection

Selecting a Personal Identification Number (PIN) introduces an added layer of security. This confidential code prevents unauthorized usage in the event of card loss or theft. Many activation processes prompt the cardholder to create a unique PIN, often requiring a combination of numbers that are difficult to guess. The cardholder may be instructed to never share their PIN with anyone, including healthcare providers or benefit administrators. A strong PIN safeguards the cardholder’s healthcare funds and prevents misuse.

-

Benefit Enrollment Confirmation

Activation may simultaneously serve as a confirmation of enrollment in the associated health benefits program. The system can cross-reference the card activation with the individual’s enrollment status, ensuring that the card is linked to an active and valid benefits package. If discrepancies arise, the activation process may prompt the individual to contact customer service for resolution. This confirmation step streamlines the overall benefits administration process and prevents the issuance of cards to ineligible individuals.

-

Terms and Conditions Acknowledgment

The activation procedure frequently incorporates an acknowledgment of the terms and conditions governing the use of the card. This might involve reviewing and accepting a user agreement detailing the card’s limitations, usage guidelines, and potential penalties for misuse. By agreeing to these terms, the cardholder acknowledges their responsibilities and obligations related to the card’s use. This step provides legal protection for both the cardholder and the benefits provider, ensuring a clear understanding of the card’s functionalities and limitations.

These elements collectively ensure that the healthcare payment mechanism is activated securely and appropriately, linking the physical card to a verified individual enrolled in a legitimate benefits program. Successful activation is the gateway to accessing the intended healthcare resources and represents a fundamental step in the overall benefits utilization process.

4. Balance Inquiry

Balance inquiry represents a crucial function intrinsically linked to the effective management and utilization of a healthcare payment mechanism. The ability to ascertain the available funds directly influences informed decision-making regarding medical expenses and service accessibility. Without a clear understanding of the remaining balance, cardholders may encounter unexpected payment declines or forgo necessary medical care due to perceived financial constraints. For example, if a cardholder requires a prescription refill but is unaware of their available balance, they might delay or skip the refill, potentially exacerbating their health condition. This demonstrates a direct cause-and-effect relationship between accessibility to balance information and responsible healthcare management.

The practical application of balance inquiry extends beyond immediate transactions. Regular monitoring of the card balance enables cardholders to track their healthcare spending, identify potential discrepancies, and plan for future medical needs. Consider a scenario where a cardholder notices an unauthorized charge through a balance inquiry. Promptly reporting this discrepancy can prevent further fraudulent activity and ensure the accurate allocation of healthcare funds. Furthermore, knowing the remaining balance allows individuals to strategically allocate funds towards specific medical services or products that align with their healthcare priorities. This proactive approach to financial management contributes to improved healthcare outcomes and greater peace of mind.

In conclusion, balance inquiry serves as an indispensable component of a comprehensive healthcare payment system. It empowers cardholders with the necessary information to make informed financial decisions, manage their healthcare expenses effectively, and prevent potential misuse or fraud. While challenges related to accessibility (e.g., reliable internet access, user-friendly interfaces) may exist, the benefits of providing readily available balance information significantly outweigh the logistical hurdles. Prioritizing accessible and transparent balance inquiry mechanisms is paramount for maximizing the value and impact of healthcare payment resources.

5. Claim Submission

The process of claim submission constitutes a pivotal element within the operational framework of a healthcare payment card. It initiates the reimbursement process for medical expenses incurred by the cardholder, effectively translating the card’s potential benefit into tangible financial relief. The absence of a functional claim submission mechanism renders the payment card largely ineffectual, as covered expenses would remain unreimbursed. For example, if a cardholder receives emergency medical treatment and the associated claim cannot be properly submitted due to system errors or procedural obstacles, the cardholder may be burdened with the full cost of the care, negating the intended benefit of the payment card. Thus, claim submission is not merely an ancillary feature but an integral component of the overall system.

Successful claim submission is contingent upon adherence to specific protocols and documentation requirements. Typically, this involves providing detailed information regarding the medical service rendered, the date of service, the provider’s identification number, and the cost incurred. In some instances, supporting documentation, such as itemized bills or referral forms, may be necessary to substantiate the claim. The accuracy and completeness of the submitted information are critical, as errors or omissions can lead to delays in processing or outright rejection of the claim. Consider a scenario where a cardholder submits a claim for a prescription medication but neglects to include the required prescription details. The claim may be denied, necessitating resubmission with the corrected information, thereby prolonging the reimbursement process. Efficient and accurate claim submission, therefore, directly impacts the cardholder’s access to financial compensation and the overall effectiveness of the payment mechanism.

In conclusion, the claim submission process serves as the critical link between medical service utilization and financial reimbursement within the healthcare payment system. Its effectiveness depends on clear guidelines, user-friendly submission methods, and efficient processing procedures. Addressing potential challenges, such as complex claim forms or lengthy processing times, is essential for optimizing the cardholder experience and maximizing the value of the healthcare payment card. Improvements in claim submission efficiency ultimately contribute to improved access to care and enhanced financial security for cardholders, further solidifying the payment card’s role within the broader healthcare landscape.

6. Renewal Process

The continuation of healthcare benefits is intrinsically linked to the established renewal process. This process ensures uninterrupted access to medical services and financial protection through the existing payment mechanism. Lapses in coverage due to incomplete or untimely renewals can create financial burdens and limit access to necessary care.

-

Notification of Renewal Eligibility

The initiation of the renewal process often commences with a notification sent to current cardholders. This notification, typically delivered via mail or electronic communication, informs the cardholder of their eligibility to renew their benefits for the upcoming period. This communication specifies the key deadlines and requirements for completing the renewal process, preventing inadvertent loss of coverage due to missed deadlines. Timely receipt and understanding of this notification are crucial for maintaining continuous access to healthcare benefits associated with the card. For instance, a notification might detail that renewal forms must be submitted 30 days prior to the expiration date of the current card.

-

Verification of Continued Eligibility

During the renewal process, continued eligibility for the healthcare benefits is re-evaluated. This may involve verifying employment status, residency requirements, or dependence status. Changes in these factors could impact an individual’s eligibility to maintain the card and its associated benefits. For example, if a cardholder’s employment status changes from full-time to part-time, this may affect their eligibility for continued coverage under certain plans. This verification step ensures that benefits are appropriately allocated to those who continue to meet the established criteria.

-

Updating Personal Information

The renewal process provides an opportunity for cardholders to update their personal information, such as address, contact details, or dependent information. Accurate and current information is vital for effective communication regarding benefits and claim processing. For instance, an outdated address could result in delayed delivery of important notifications or reimbursement checks. Maintaining accurate personal information ensures seamless access to healthcare services and efficient administration of the payment mechanism.

-

Acknowledgement of Updated Terms and Conditions

Benefit plans and coverage terms may evolve over time. The renewal process often requires cardholders to acknowledge and accept any updated terms and conditions associated with the payment card. This ensures that cardholders are aware of any changes in coverage, limitations, or utilization guidelines. For example, the formulary for prescription medications may be updated annually, requiring cardholders to review and acknowledge these changes. This acknowledgement safeguards both the cardholder and the benefits provider by ensuring a clear understanding of the current agreement.

The renewal process, therefore, extends beyond a mere administrative formality. It ensures that individuals retain uninterrupted access to vital healthcare benefits, subject to continued eligibility and adherence to updated terms. This ongoing process contributes to stability in healthcare coverage and supports responsible utilization of the healthcare payment mechanism.

Frequently Asked Questions

The following addresses common inquiries regarding the healthcare payment mechanism, aiming to clarify its usage and associated guidelines.

Question 1: What recourse is available if the payment card is lost or stolen?

Upon realizing the card is missing, immediate notification to the issuing institution is imperative. This action will trigger the card’s deactivation, preventing unauthorized usage. A replacement card will typically be issued following verification of identity and adherence to established security protocols.

Question 2: Is it permissible to transfer funds from the payment card to another account?

Generally, the transfer of funds from this specific payment mechanism to external accounts is prohibited. The card is designated solely for healthcare-related expenses as defined by the associated benefits program. Attempts to circumvent this restriction may result in penalties or termination of benefits.

Question 3: How is eligibility for the payment card determined, and what factors can affect ongoing eligibility?

Eligibility is contingent upon meeting specific criteria established by the benefits provider, often including employment status, dependent status, and adherence to enrollment deadlines. Changes in these factors, such as termination of employment or loss of dependent status, may impact continued eligibility. It is the cardholder’s responsibility to report such changes promptly.

Question 4: What constitutes an eligible expense for utilization of the payment card?

Eligible expenses are defined by the specific healthcare benefits plan associated with the card. Generally, these encompass medically necessary services and treatments, including prescription medications, specialist consultations, and preventative care. A detailed list of eligible expenses is typically provided in the plan documentation.

Question 5: What is the procedure for disputing a transaction appearing on the payment card statement?

In the event of a disputed transaction, immediate notification to the card issuer is required. A formal dispute must be filed, providing detailed information regarding the transaction in question and supporting documentation, if available. The issuer will then conduct an investigation and resolve the dispute in accordance with established protocols.

Question 6: How can cardholders access a detailed transaction history associated with the payment card?

Access to transaction history is typically provided through an online portal or by contacting customer service. Regular review of transaction history is recommended to monitor expenses and identify any potential discrepancies or fraudulent activity.

Key takeaways emphasize prompt reporting of lost or stolen cards, adherence to eligibility requirements, understanding of covered expenses, and proactive monitoring of transaction history.

The following sections will provide practical guidance on maximizing the benefits of this healthcare payment mechanism.

Optimizing the s3 health benefits card

The following recommendations aim to maximize the utility of this healthcare payment mechanism, fostering responsible and informed usage.

Tip 1: Familiarize with Plan Specifications: Comprehend the detailed terms and conditions of the associated healthcare plan. Understanding covered services, limitations, and co-payment structures is paramount. Neglecting this step may lead to unexpected out-of-pocket expenses. Example: Confirming if a specific medical procedure requires pre-authorization prior to scheduling the appointment.

Tip 2: Monitor Available Balance: Regularly check the available balance through the designated online portal or customer service channels. Consistent monitoring prevents declined transactions and allows for proactive budgeting of healthcare expenses. Example: Verifying the card balance before filling a prescription to ensure sufficient funds are available.

Tip 3: Retain Detailed Records: Maintain a comprehensive record of all transactions conducted with the payment instrument. These records should include dates, service providers, and amounts. Such documentation aids in reconciling statements and resolving potential discrepancies. Example: Saving receipts from pharmacy purchases and doctor’s visits for future reference.

Tip 4: Promptly Report Loss or Theft: In the event of loss or theft, immediate notification to the issuing institution is crucial. This action mitigates the risk of unauthorized usage and facilitates the timely issuance of a replacement card. Example: Contacting the benefits administrator within 24 hours of discovering a missing card.

Tip 5: Safeguard Personal Identification Number (PIN): Treat the PIN as confidential information. Avoid sharing it with unauthorized individuals or storing it in an easily accessible location. A compromised PIN can lead to fraudulent transactions and potential financial loss. Example: Memorizing the PIN instead of writing it down on the card or in a mobile device.

Tip 6: Submit Claims Accurately and Timely: Adhere to the established procedures for claim submission, ensuring accuracy and completeness of all required information. Timely submission maximizes the likelihood of prompt reimbursement for eligible expenses. Example: Double-checking the provider’s information and service dates on the claim form before submitting it.

Tip 7: Utilize In-Network Providers: When feasible, prioritize seeking medical services from in-network providers. This often results in lower out-of-pocket expenses and simplified billing procedures. Example: Consulting the plan’s provider directory to identify participating physicians and specialists.

Adherence to these recommendations promotes informed and responsible utilization of the instrument, maximizing its value within the framework of the intended healthcare benefits.

The concluding section will synthesize the key points discussed throughout this article.

Conclusion

This exploration of the s3 health benefits card has elucidated its core functionalities, eligibility criteria, and utilization guidelines. The discussion has underscored the significance of understanding covered services, adhering to proper activation procedures, and maintaining diligent oversight of account balances. The complexities of claim submission and the necessity of timely renewals were also addressed, highlighting the multi-faceted nature of this healthcare payment tool.

Effective management of the s3 health benefits card requires proactive engagement and a thorough understanding of its parameters. Responsible utilization not only maximizes the card’s intended benefits but also contributes to a more informed and empowered approach to personal healthcare management. Continued awareness and adherence to established protocols remain paramount for ensuring optimal access to healthcare resources and safeguarding against potential financial burdens.